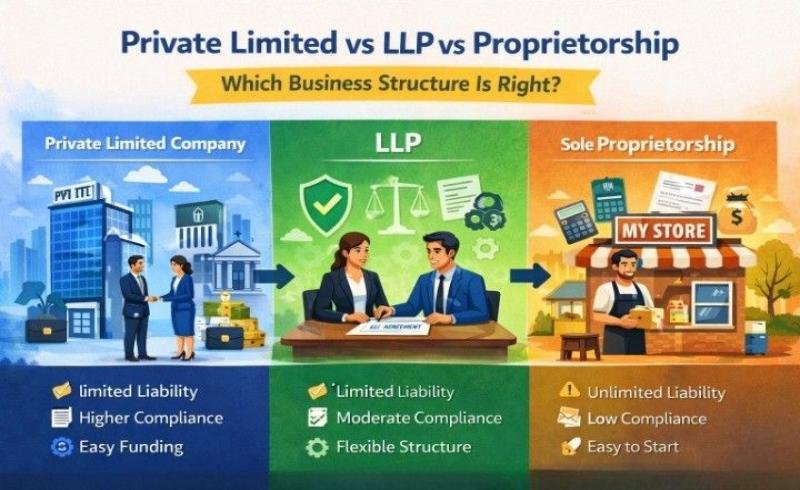

Choosing a business structure feels a bit like choosing a life partner. It decides how much freedom you get, how much responsibility you carry, and how messy things can become if something goes wrong. Many entrepreneurs in India struggle with LLP vs proprietorship or even partnership vs private limited because the differences look small on paper but matter a lot in real life.

If you are exploring Company Registration in Mayur Vihar, this guide will help you make a practical decision before filing any forms. Firms like AABK & Associates, listed on Google My Business, often see founders change structures later simply because they rushed this step. Let us make sure that does not happen to you.

Your legal business structure controls taxation, compliance, liability, and even how investors see you. According to the Ministry of Corporate Affairs and Income Tax Department guidelines, the structure also decides reporting rules and penalties. This is why a clear business structure comparison matters before you register anything.

India mainly offers three popular options for small and growing businesses:

Sole Proprietorship

Limited Liability Partnership (LLP)

Private Limited Company

Each suits a different stage and mindset.

A sole proprietorship business is the simplest form to start. One person owns and controls everything. There is no separate legal identity between you and the business.

Easy and low-cost setup

Minimal compliance

Owner and business are the same in law

This structure works well for freelancers, consultants, and local traders. However, liability remains unlimited. If the business incurs debt, your personal assets stay exposed. As per Income Tax rules, profits get taxed as personal income.

When people compare proprietorship vs LLP, this unlimited liability becomes the biggest concern.

A limited liability partnership blends flexibility with legal protection. It gives partners limited liability while keeping compliance lighter than a company.

Separate legal entity

Limited liability for partners

Lower compliance than private limited

The LLP Act, 2008, clearly defines partner responsibilities. This makes LLP a favorite choice for professionals like CA firms, law firms, and service startups. In the LLP vs proprietorship debate, LLP wins on safety and credibility.

Still, LLPs face limits when raising equity funding since investors usually prefer shares.

A private limited company is a separate legal entity governed by the Companies Act, 2013. It works best for scalable and investment-ready businesses.

Strong legal identity

Limited liability

Easy equity funding

When founders compare partnership vs pvt ltd, private limited companies often come out ahead for growth. Banks, VCs, and government tenders trust them more. Compliance is higher, but the credibility payoff is real.

Let us simplify this common confusion.

If you plan long-term operations, proprietorship vs LLP usually tilts toward LLP for safety and structure

Traditional partnerships still exist, but they come with shared liability risks. Under the Indian Partnership Act, partners remain personally liable for business losses.

This is where partnership vs private limited becomes important. Private limited companies protect shareholders and allow structured growth. According to MCA data, most funded startups in India register as private limited entities for this reason alone.

Each structure carries different compliance duties defined by MCA and CBDT.

Proprietorships follow individual tax slabs

LLPs face flat tax plus limited filings

Private limited companies follow corporate tax rules with regular ROC filings

In a fair business structure comparison, compliance should feel manageable, not scary. Professional help ensures that filings stay clean and timely.

If you are looking for Company Registration in Mayur Vihar, Company Registration in Laxmi Nagar, or Company registration in Vishwas Nagar, local expertise helps with documentation and follow-ups. Firms like AABK & Associates, available via their Google My Business profile, understand regional compliance nuances and practical challenges faced by small businesses.

This local support often reduces errors during registration and post-incorporation filings.

Here is a simple logic-based approach:

Choose proprietorship if you want speed and simplicity

Choose LLP if you want protection without heavy compliance

Choose private limited if you plan growth, funding, or expansion

Your choice should align with risk appetite, growth plans, and compliance capacity.

This article aligns with information published by:

Ministry of Corporate Affairs (mca.gov.in)

Income Tax Department of India

LLP Act, 2008 and Companies Act, 2013

These sources define registration, taxation, and compliance standards used nationwide.

There is no universal winner in llp vs proprietorship or partnership vs private limited debates. The right answer depends on where you are today and where you want to go tomorrow. A small decision today can save years of restructuring later.

If you want expert guidance for Company Registration in Mayur Vihar, Company Registration in Laxmi Nagar, or Company registration in Vishwas Nagar, consult professionals like AABK & Associates to choose a structure that fits your goals, not just your budget.

A smart start builds a stronger business.